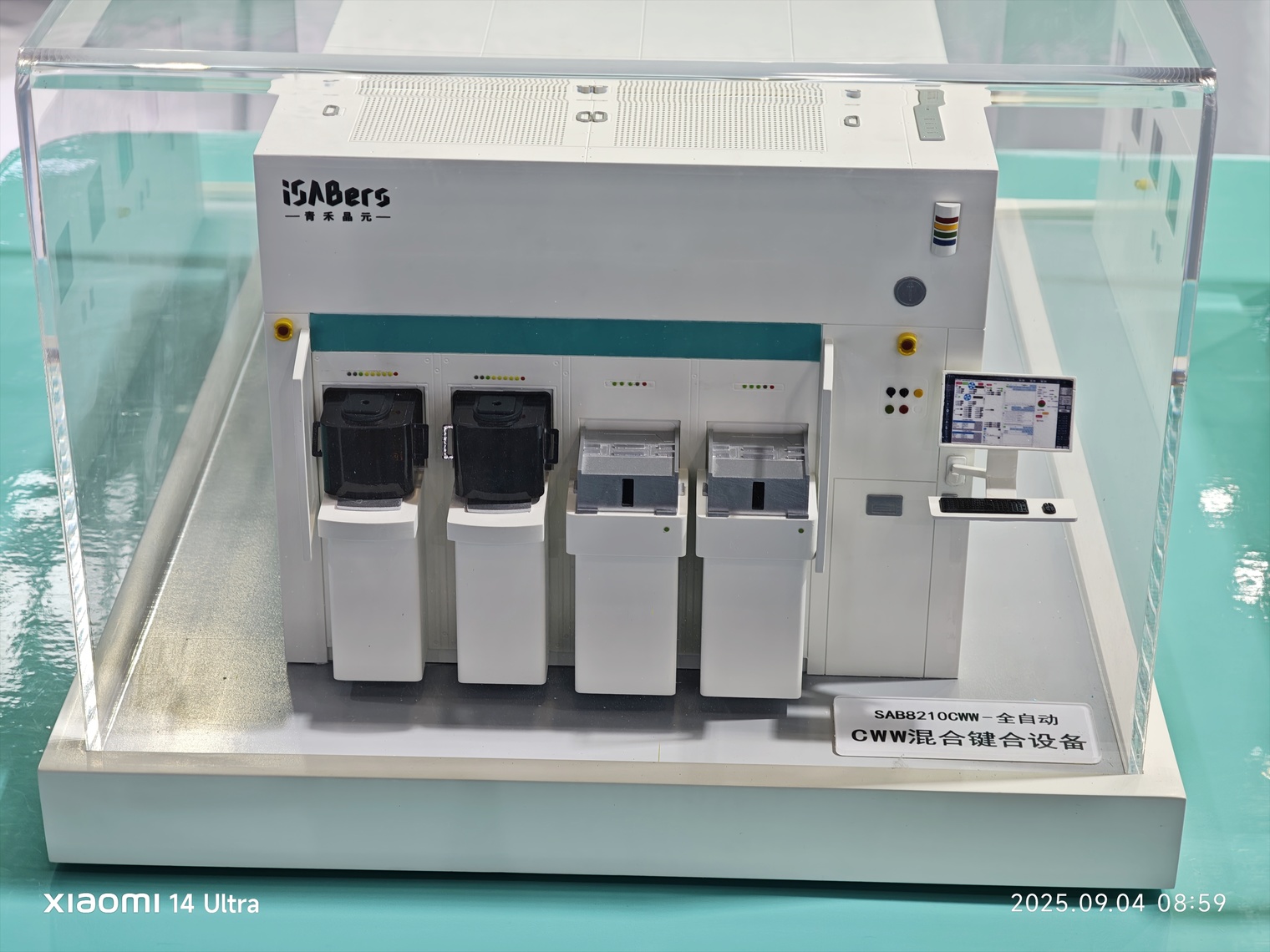

Model of a semiconductor hybrid bonding device, photographed by the author during the Semiconductor Equipment, Core Components & Materials Exhibition (CSEAC 2025)

AsianFin -- Huawei’s latest product launch marks the return of its Kirin 9020 chip after four years, a move industry experts say could reshape China’s semiconductor sector.

The Kirin 9020 powers Huawei’s latest tri-fold Mate XTs smartphone, delivering a 36% performance boost while reducing power consumption by 20%. The comeback is being hailed as a milestone for China’s domestic semiconductor supply chain, including design, manufacturing, and equipment sectors.

During the 13th Semiconductor Equipment and Core Components & Materials Exhibition (CSEAC 2025) on the same day, Yin Zhiyou, founder and chairman of Advanced Micro-Fabrication Equipment Inc. China (AMEC), highlighted the market potential for China’s chip equipment sector.

Yin projected that the global semiconductor equipment market will surpass $110 billion in 2025, with China remaining the largest single market for the fifth consecutive year at an estimated $38.1 billion, representing 35% of global sales.

Despite the rise in local production, overseas equipment still dominates China’s market. Yin noted that the localization rate increased from 14% in 2024 to 18%, leaving over 70% of equipment purchases reliant on foreign suppliers. He emphasized the need to curb “involution,” a term describing unhealthy competition that undermines industry development, citing instances of talent poaching, IP theft, and other disruptive practices in the semiconductor sector.

“We must firmly oppose involution and vicious competition,” Yin said. He called for the consolidation of smaller firms with mature companies to foster a healthier ecosystem, reduce internal friction, and accelerate the domestic equipment industry’s progress.

Industry analysts argue that domestic equipment is improving but hasn’t yet fully met the requirements of high-end wafer fabrication. Over the past year, China’s front-end wafer manufacturing equipment for integrated circuits has grown rapidly due to increased domestic chip production and tighter import controls.

According to the China Electronic Production Equipment Industry Association, 82 major semiconductor equipment manufacturers in mainland China reported total sales revenue of RMB 117.87 billion in 2024, up 32.9% year-on-year. The top ten manufacturers accounted for 80.7% of this revenue, totaling RMB 95.1 billion — a 38.3% increase over 2023.

However, despite growth in domestic sales, some sectors lag behind in technological capability. Step-and-repeat projection lithography machines, metrology equipment, chemical vapor deposition tools, ion implanters, wafer coating and developing machines, and probe stations all remain below 5% domestic market share. As a result, many fab customers still rely on international suppliers like ASML, KLA, Applied Materials, and Tokyo Electron, especially for high-end devices.

“Customers buy overseas equipment because it meets their requirements for performance and reliability,” said Chen Ji, President of Beijing NAURA Microelectronics Equipment Co., Ltd. “It’s an understandable choice until domestic products reach full substitution levels.”

Executives from CETC Electronic Equipment and Naura Technology Group emphasized that building customer trust and maintaining profit margins are crucial. Wang Ping, General Manager of CETC Electronic Equipment, said, “We can’t blame the customers—they are always right. But with proper policies and top-level planning, China can gradually develop domestic equipment that matches or surpasses international standards.”

The domestic chip equipment market now hosts nearly 30 relatively mature companies with 15 years of experience, alongside dozens of smaller, specialized firms. Yin and other industry leaders argue that fostering mergers and discouraging predatory practices can create a healthier competitive environment.

Huang Chongji, Chairman of Shanghai Microtron Semiconductor Equipment Co., Ltd., outlined four key principles for domestic companies: focus on high-quality products, meet customer customization needs, pursue technological innovation, and maintain profit margins to fund R&D. “Without reasonable margins, the industry risks endless price wars, or involution,” Huang said.

Meanwhile, AMEC plans to develop 102 new devices over the next three to five years across plasma etching, optical metrology, and electron beam metrology, with total R&D investment nearing RMB 13 billion. Yin emphasized that surpassing global benchmarks requires understanding the strengths and weaknesses of the world’s top equipment and integrating the best of both worlds into domestic innovations.

AI is emerging as a critical driver of semiconductor equipment demand. Moore Threads CEO Zhang Jianzhong highlighted that current generative AI and agentic AI technologies require more than 7 million GPU cards, but China’s production capacity still faces a shortfall of 3 million units. Each wafer produces roughly 20–30 effective compute cards, meaning domestic output cannot meet current demand.

“The domestic computing power market is facing a shortage in the short to medium term,” Zhang said. The constraints are compounded by international embargoes on high-end chips, restrictions on HBM memory sales, and limits on advanced process technologies. To address these challenges, China must improve its computing power infrastructure and strengthen the domestic supply chain.

Du Lijun, President of Sicarrier Industrial Machinery Co., Ltd., noted that growing AI and intelligent driving applications are driving steady growth in semiconductor equipment. Equipment evolution is moving toward higher energy control precision, faster hardware response, and larger process windows. For example, energy control precision is expected to improve tenfold and hardware response speed to accelerate during the transition from 7nm to 3nm processes.

According to SEMI, China is expected to achieve full independent control over 28nm process equipment by 2030, with 14nm equipment entering verification and domestic DUV lithography machines achieving full-chain localization. AI and big data integration will enhance production efficiency and competitiveness.

SEMI forecasts the global semiconductor industry to surpass $1 trillion by 2030, with manufacturing alone exceeding $300 billion. Major trends shaping this growth include geopolitical restructuring, shifts in global trade, and the transformative impact of generative AI.

In 2025, mainland China’s semiconductor equipment sales are projected to reach RMB 140 billion, an 18.8% increase year-on-year, with integrated circuit equipment expected to grow by 30%.

Huawei’s Kirin 9020 revival and China’s semiconductor equipment boom represent more than technological milestones—they signal a strategic push toward self-reliance amid global trade uncertainties. As domestic equipment matures and AI-driven demand surges, China’s semiconductor ecosystem may begin to rival the long-standing dominance of international suppliers.

For now, overseas equipment continues to dominate high-end production, but industry leaders remain optimistic that domestic capabilities will catch up. The focus, they say, must remain on innovation, quality, and sustainable competition.

“The domestic semiconductor industry has reached a turning point,” Yin said. “With careful planning, investment, and a focus on ethics and innovation, China can build an equipment ecosystem that is globally competitive and capable of supporting the next wave of technological growth.”

(Note: 1USD equals about 7.25 yuan)